Key takeaways

|

Besides the W-2, the 1099 Form is one of the most common tax forms in the United States. However, with more than 20 types of 1099 Forms available, it can be difficult to understand what a 1099 Form means and what to do with it. Here’s everything you need to know about a 1099 Form and how it works.

Featured Partners

What is a 1099 Form used for?

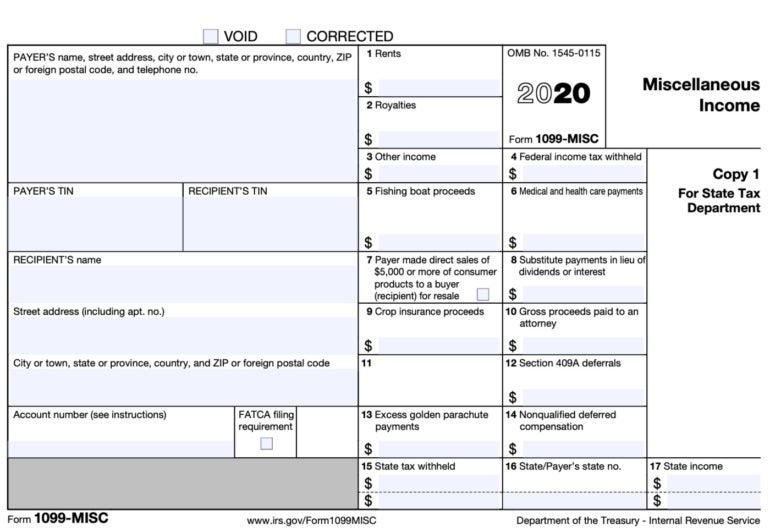

The 1099 Form is used to report certain kinds of non-employment income to the IRS. There are 20 total varieties of 1009 forms. Some of the most popular are 1099-INT, 1099-DIV, 1099-MISC and 1099-NEC (Figure A).

Figure A

Who receives a 1099 Form?

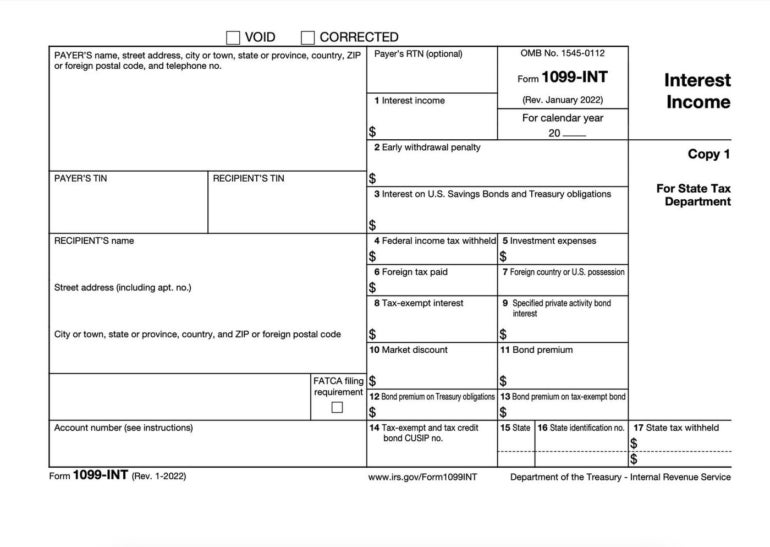

Many different people can receive a 1099 Form for different reasons. They might have been paid more than $600 for a freelance contractor job or received more than $10 in interest on a savings account (Figure B). See the list of types of 1099 later in this article to get a sense of the different scenarios where you might receive a 1099 Form.

Figure B

If you’re a 1099 employee, you should receive a paper copy of your form, but you may also be able to access it electronically by logging into your bank account, a business’s payroll software or another online portal.

Who sends 1099 Forms?

Likewise, many different people and organizations need to send out 1099 forms every year. The IRS provides a guide that explains who needs to file a form 1099 or other information return. If you are a small-business owner, you need to file a 1099 Form for each non-employee, freelancer or independent contractor you paid more than $600 to during the calendar year.

You can make this process easier by using payroll software.

Need help managing 1099s?If you have 1099 contractors in your business, you can use Gusto to help you keep track of the tax paperwork. With Gusto’s integrated contractor payments, automated 1099 filing and 1099 distribution service, you can easily get 1099-NECs to the IRS and your contractors within the designated time frame, which can save you a lot of headache. |

Do I need a 1099 Form to file my taxes?

While you need to send in a W-2 form when you file taxes, you don’t actually need to send in your 1099 Forms to the IRS when you file. That’s because the business or person issuing your 1099 also sends a copy directly to the IRS. Even if your copy of the 1099 Form is late or gets lost in the mail, you can still file your taxes on time. However, you do need to report the income listed on your 1099 on your tax filing.

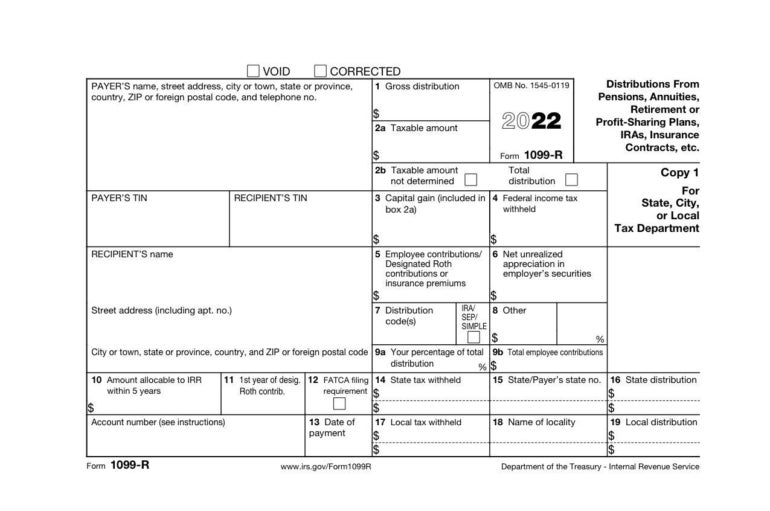

The one exception is the 1099-R Form, which tracks money taken from retirement accounts, pensions, IRAs, insurance contracts and other similar accounts. If Box 4 on the form shows that federal income tax was withheld, then you do need to attach a copy of that 1099-R to your tax return.

When are 1099s issued?

The deadline for businesses to send out 1099 Forms is typically January 31 of the following year (though in a few cases the deadline may be February 15). In other words, 1099 Forms for 2023 should be mailed out by January 31, 2024. If you’re a 1099 employee and it’s getting into February with no sign of your 1099 Form, reach out to the issuer to get it re-sent.

Types of 1099 Forms

Here are the most popular types of 1099 Forms you need to know about:

Form 1099-DIV

This form is used if the recipient owns a stock or mutual fund that pays dividends.

Form 1099-INT

This form is used if the recipient has a checking, savings or other type of bank account that pays interest.

Form 1099-MISC

This form is used if the recipient was paid non-employee compensation that is not subject to employment tax, such as rent money or prize money.

Form 1099-NEC

This form is used if the recipient was paid non-employee compensation that is subject to employment tax, such as freelance work or attorney services.

Form 1099-K

Right now, this form is used if the recipient has over 200 transactions that total $20,000 or more on a third-party payment platform such as Venmo or PayPal. In 2024, that threshold will be lowered to $600, so expect to get more 1099-K forms in the future.

Form 1099-B

This form is used if the recipient sold securities at a brokerage or barter exchange. Note that those who qualify will receive this form regardless of whether they made or lost money.

Form 1099-R

This form is used (Figure C) if the recipient received $10 or more from their IRA or another source of retirement income. The full name of this form is Form 1099-R: Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Figure C

What do I do if I don’t get all of my 1099 Forms?

If you are expecting 1099 Forms and have not received them by the first week or so of February, reach out to the payer to get the 1099 Form re-issued. If you still haven’t received the form by February 15, contact the IRS for help by calling 1-800-829-1040.

You might be able to find your missing 1099 information from other sources, so you can still file your taxes on time. For instance, you should be able to find the interest your bank paid you on a savings account by checking your online statements for the year. If the company that paid you uses payroll software, you may also be able to log in and view electronic copies of your 1099 Forms.

Frequently asked questions (FAQs)

Can I file a 1099 Form electronically?

Yes, you can file a return electronically with the IRS using the Information Returns Intake System (IRIS). In fact, starting in tax year 2023, you must file electronically if you have 10 or more information returns, including 1099 Forms. Business solutions like payroll software for small businesses can make it easier to electronically generate and file 1099s for all relevant workers.

What is the difference between filing 1099s and W-2s?

A W-2 is a tax form that is used for employees whose employers have withheld taxes from their paycheck. A form 1099 is used for contractors, freelancers and other non-employees who do not have taxes deducted from their payments. They are responsible for calculating and paying their own taxes.

What does a 1099 employee mean?

A 1099 employee is an independent contractor who does not have tax withheld from their paycheck by an employer. Some types of 1099 employees include freelancers, consultants, self-employed workers and sole proprietors.

What if I ignore the 1099 Form?

Because 1099 Forms are also reported to the IRS, the IRS already knows how much money you have made for the year. If you ignore a 1099 Form and don’t list that income on your tax return, then the IRS will catch the discrepancy. In these cases, you will probably be notified and then retroactively charged penalties and interest beginning on the date you owed the additional tax.

Looking for payroll software that will help you file 1099s for your business? Check out our complete guide that explains how to choose payroll software.

Featured payroll solutions

1 Deel

Run payroll in 100+ countries and 200+ currencies from a single place. Deel’s comprehensive global platform eliminates the ongoing admin of local compliance, taxes, and benefits. With in-house experts across 100+ countries, dedicated CSM’s, visa and PTO support, and more, Deel provides unmatched payroll expertise and service. Plus, with a single point of contact, we eliminate handovers, providing you with faster support and compliance, so your entire global team gets paid quickly and securely.